When most folks think about how to cut expenses from their budget, it’s usually an “either/or” scenario…

- Take a nice vacation OR save for junior’s college fund.

- Date night out OR pay extra towards the mortgage.

- Cappuccino from Starbucks OR mystery liquid from work.

Although sometimes this is true, many times there’s a third option or a middle ground, so to speak.

A fellow advisor friend of mine calls it the “step-down” principle.

If you’re someone who’s always had trouble cutting expenses from your budget, then keep reading. This principle can completely transform your spending and saving decisions.

What is the step-down principle?

The step-down principle is an answer to the question of how to cut expenses from your budget without significantly impacting your lifestyle.

Instead of an “all or nothing” approach when asking yourself how to cut expenses, the step-down principle allows you to gradually reduce your expenses over time.

In certain cases, the “all or nothing” approach is completely justified and is the only recommended course of action.

For example, if you have substantial consumer debt (i.e. credit card debt, payday loans, etc.), going cold-turkey when cutting some expenses is the only way to go, in my opinion (check out this blog post and this one for a few more examples).

But in many circumstances, a more gradual approach will help you learn how to cut expenses, while also allowing you to build better spending habits over time.

Say goodbye to that awful feeling most people get in their stomach when they think about how to cut expenses from their budget.

How to cut expenses by “stepping down”

For example, let’s say you’re trying to free up cash to help pay down debt or save for some future financial goal.

To do that, you’ve determined you need to save approximately $100/month more than what you’re currently saving.

But after trying to put together a budget, you aren’t sure how to cut expenses from your budget, without making significant altering your lifestyle.

This is where many people throw their arms in the air and give up, “See, I told you budgeting doesn’t work!”

Not so fast!

Enter the step-down principle.

A real life example of how to cut expenses

Continuing with the example above, let’s also say that you and your spouse go out for dinner and a movie every Saturday night.

And let’s say it costs around $50, on average, for 2 people to go out for dinner and a movie (this would actually be a pretty good deal nowadays!).

That means you’re spending approximately $200/month ($2,400/year) on this weekly night out.

Now, what if, in lieu of your night out on the town every week, you decided to pick up a pizza and rent a movie to watch at home EVERY OTHER WEEK?

In other words, you’d still be doing dinner and a movie each week, but instead of going out every week, you’ve “stepped-down” to every other week out, and every other week in.

This would save you approximately $100/month, without significantly altering your lifestyle.

Too much of a “step-down” for you?

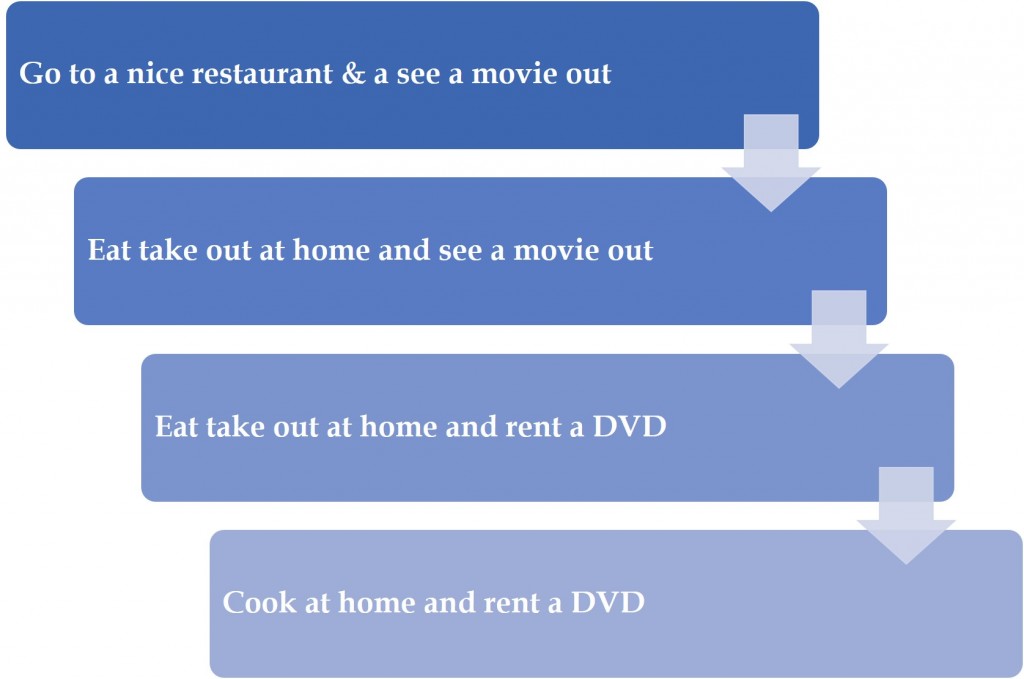

Check out the picture below to see other examples of how you could step-down your level of spending when it comes to dinner and a movie.

(Click here to enlarge image)

Of course, this is a simplified example, but the principle can be applied to almost every area of your spending.

A few more examples

Many times, you can make significant cuts to your budget, without a huge impact to your standard of living. The examples below should help get you started.

Spending too much on that beach vacation, but still want to dip your toes in the sand?

- Try “bidding” on travel websites like Priceline and Hotwire to take the same trip for less money.

Spending too much on take out, but don’t have time to cook?

- Try ready-to-cook meals in the freezer section of the grocery aisle.

Spending too much on coffee, but can’t see yourself giving up your daily Starbucks trip?

- Buy a Keurig and make your fancy coffee at home with the push of a button.

As you you can see, it’s rarely an “either/or” decision when it comes to the question of how to cut expenses.

Next time you’re looking at your budget and it seems your spending is a tad too high, the solution may be as easy as taking “one step down.”

Need some help on the best way to “step-down” your spending?

Schedule Your Complimentary Initial Phone Call

Click the button above to schedule a complimentary 15-minute initial phone call at your convenience.