A few weeks ago, millions of people around the world made New Year’s resolutions and set goals for 2015.

And in the last few weeks, millions of these people have failed miserably at keeping these resolutions.

So, what gives?

I think one of the biggest reasons people fail to keep their New Year’s Resolutions is analogous to the parable Jesus told his disciples in Matthew 7:24-27 (ESV)…

Everyone then who hears these words of mine and does them will be like a wise man who built his house on the rock. And the rain fell, and the floods came, and the winds blew and beat on that house, but it did not fall, because it had been founded on the rock.

And everyone who hears these words of mine and does not do them will be like a foolish man who built his house on the sand. And the rain fell, and the floods came, and the winds blew and beat against that house, and it fell, and great was the fall of it.

Like the foolish man who built his house on the sand, too often our method of setting goals and New Year’s resolutions is haphazard and has no foundation.

Most of us tend to set goals like this…

- Lose weight

- Pay off debt

- Get a better job

- Start exercising

- Budget

- Apply for jobs

These goals aren’t bad in and of themselves, but if this is our method for setting goals, then when the proverbial floods of life come and the winds of life blow…and they will…we will most likely fall.

And just like the foolish man in the parable…great will be our fall.

A better way

Fortunately, there is a better way that will hopefully help us avoid a similar fate in the future!

Below are three simple truths that have helped me over the years when it comes time to setting and working towards accomplishing my New Year’s resolutions and goals.

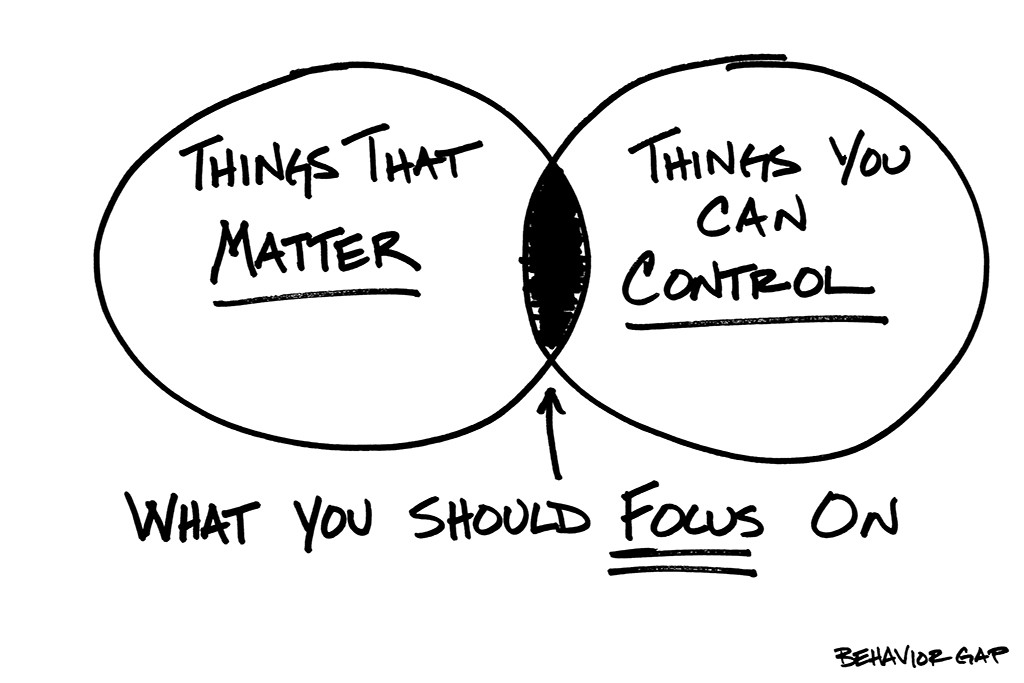

- 1. There are things in life that matter

- 2. There are things in life you can control

- 3. Focus your energy on the things that matter AND the things you can control

The picture that outlines these three statements at the top of this post is compliments of Carl Richards, a New York Times best-selling author and financial advisor colleague of mine.

As you can see, there is nothing magical about these statements, but your understanding and implementation of these truths can have a huge impact on whether or not you have a good chance of sticking to your New Year’s resolutions and reaching your goals.

1. There are things in life that matter

We all know that some things in this life “matter” more than others.

Being a loving spouse, parent, child, friend, or neighbor is obviously much higher on the list than being the best person at, say…parallel parking a car.

Here’s some food for thought…if you stuck to your New Year’s resolutions this year, would the results matter in…

- 10 years?

- 25 years?

- 50 years?

- 100 years (or more)?

If the answer is no…then it might be time to rethink your New Year’s resolutions.

Many people set goals and New Year’s resolutions without considering whether or not a particular goal matters in the grand scheme of things.

Don’t be one of them.

2. There are things in life you can control

If you make New Year’s resolutions based on things you can control, then your chances of reaching your goals will be much greater.

For example, I would absolutely love to keep the weather in Tulsa, OK at a constant 80-degrees, with clear and sunny skies, low humidity, and no wind to speak of.

The only problem, is that I have absolutely zero control over the weather, so to make a New Year’s resolution regarding the weather would be ludicrous.

Now, what I CAN do is make a New Year’s resolution to look for a new job in a location with a higher than average percentage of good-weather days (i.e. Arizona, Southern California, southern Florida, etc.).

Do you see the subtle, yet crucial difference?

For the most part, I can control the latter, but the former is just a “castle in the sky” dream.

3. Focus most of your energy on the intersection of things that matter AND things you can control

Just like the photo at the top of the post, the best goals or New Year’s resolutions are usually at an intersection of where the previous two statements meet.

If you focus on these two things, then the odds of actually keeping your New Year’s resolutions and accomplishing your goals should be much higher.

For example, you might set a New Year’s resolution to pay off debt so that you can free up extra money to save for your children’s future education (i.e. something that matters).

You plan to do this by working extra overtime for the next 6 months and using all that extra money to help pay off your debt (i.e. something you can likely control).

Doesn’t that sound like a better New Year’s resolution than, “pay off debt”?

Yeah, I thought so, too!

One caveat for your New Year’s resolutions

Now, this certainly doesn’t mean you’ll always reach your goals or stick to your New Year’s resolutions.

There are obviously thousands of things in this life that are out of your control, but by following the recommendations above, you’re certainly giving yourself a better chance of success.

Hopefully, it will help you be more like the wise man in the parable who built his house on the rock.

When the floods come and the winds blow (and they will!), you’ll simply watch as they come and go, all while your house stands strong in the storm.

Need help setting and sticking to YOUR financial New Year’s resolutions?

Schedule Your Complimentary Initial Phone Call

Click the button above to schedule a complimentary 15-minute initial phone call at your convenience.

Tyler, good article. – Brad Leath

Thanks Brad, I’m glad you enjoyed it! I hope all is well with you and your family!